- TheFundCFO Newsletter

- Posts

- #182 VCs Closing Q3 w/ Playbook, Model, Valuation Updates

#182 VCs Closing Q3 w/ Playbook, Model, Valuation Updates

👋 Happy Thursday folks!

Every Tuesday/Thursday, we publish VC/CFO insights that matter - highlights from notable VC GPs, LPs, and CFOs/finance pros.

Love what we’re doing? Consider upgrading to paid for deeper dives on Thursdays (most paid subscribers expense these insights!). Scroll down for more!

“There are no failures - just experiences and your reactions to them.”

Picture of the Day: Barton Springs in Austin, TX

Recap

The Latest & Greatest Fund CFO Posts

#163 Top 7 VC CFO Posts of H1 2024 (All In One Place)!

The Quarterly Closeout

Happy last week of Q3 - time to close it out! At the end of each quarter, we look back at the past three months, professionally and personally. What worked well (celebrate the wins!) and what didn’t? What can we change to make the next three months even better?!

Revisiting The Year-End CFO/Finance Checklists at Q3

Our year-end process can easily be applied to the end of Q2. We’ve seen a lot of different frameworks over the years to keep track of all the requirements for funds at year-end. One of our favorites is breaking things down into four buckets: portfolio companies, investor reporting, compliance/legal, and operations/HR. Here’s some of the top items in each bucket for year-end…

VC Valuation Headlines & Policies

At the end of the quarter, it’s also valuation time! It’s time to review your valuation policies and make sure they provide the right foundation for investor reporting. Valuations were a super hot topic last year at this time! At Q2’23, we reported the following:

“Union Square Ventures slashed the value of 7 of its funds by 26%.” This was appears to be an average across a number of funds. Over the same time, other venture holdings in UTIMCO’s vast venture portfolio either increased or experienced slight declines. Sequoia marked up 16 funds. Y Combinator kept two funds virtually unchanged. GGV Capital marked down.”

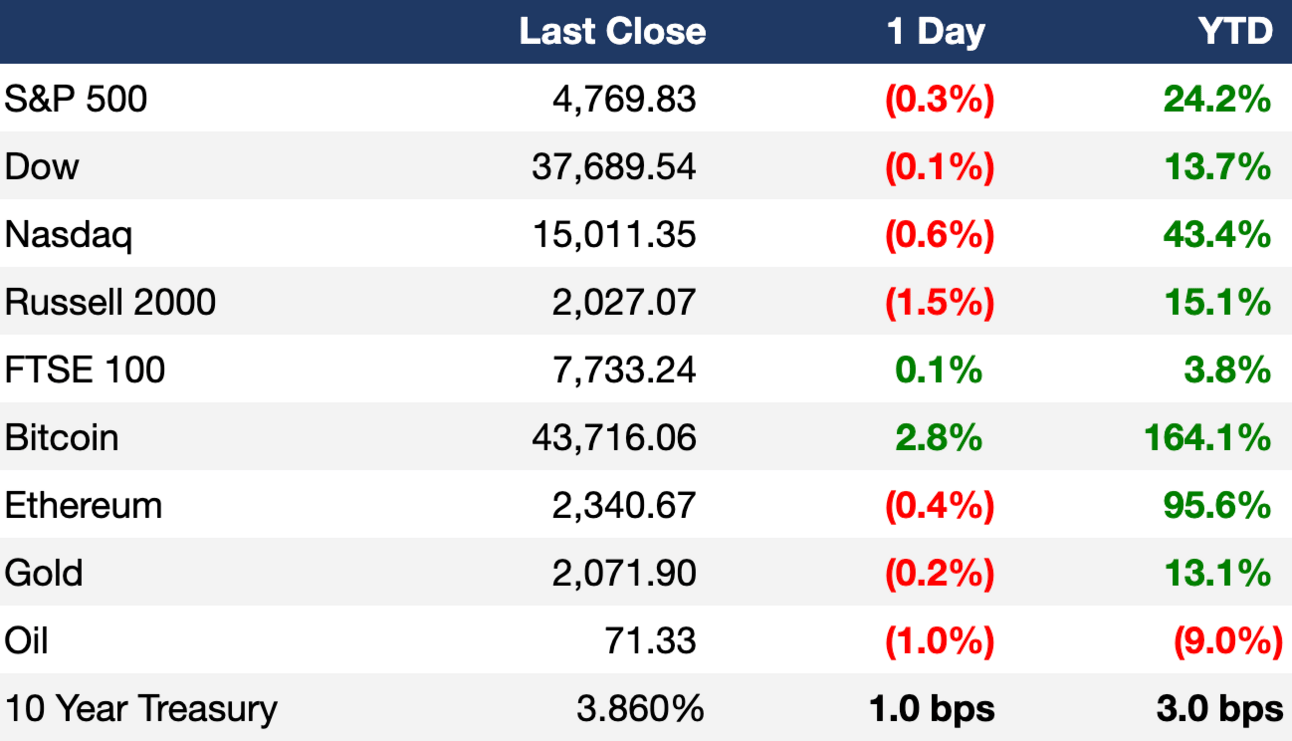

As usual, there’s no universal clear answer on how your portfolio should be marked. It depends on a number of factors, including the individual companies, vintage year of the fund / investment, types of of securities you hold, and public market comparables, etc. At that time, we wrote that the S&P 500 is up 18% and the NASDAQ is up 34.5% in 2023 for reference. The S&P 500 finished 2023 up 24% and the NASDAQ finished up 43%.

For Reference: 2023 Performance as of 12/29/23 close:

VC Valuation Policy - Time to Revisit

We’ve written previously about VC Valuation Resources & Policies:

Private equity and venture capital firms are required to value their portfolio of investments quarterly. Those values are published on a schedule of investments (SOI) that is shared with investors and establishes the value of the PE/VC investment fund. At year-end, they review these valuations in detail with their auditors, who are required to sign-off on the numbers.

In case you haven’t heard, 2022 was a challenging year for technology stocks (-30%+) and venture capital, making the Q4’22 valuation process even more challenging! You can read more via these links about What Happened in 2022 and What Will Happen in 2023 (thanks Fred Wilson). His more recent recaps share additional color: What Happened in 2023 and What Will Happen in 2024 (linked).

Updating Your Valuation Policy

There isn’t a one-size fits all approach to quarterly valuations! It is driven by where you invest (early vs. late-stage, etc.), the asset type, and your investor, legal, accounting, auditing requirements, and other factors. To recap, a valuation policy is an outline of the approach your fund takes to determine the fair value of its portfolio company assets for financial reporting. Fund valuation policies are usually flexible frameworks that VC funds create for their portfolio company investments.

The American Institute of Certified Public Accountants (AICPA) provides guidance to help fund managers and other stakeholders (such as auditors, investors, and valuation specialists) understand the valuation process. The guidance outlines current best practices for valuing investment assets in accordance with U.S. Generally Accepted Accounting Principles (GAAP) and the accounting standard known as ASC 820.

Once established, a fund’s valuation policy isn’t set in stone: You can and should assess and adjust your fund’s valuation policy to be sure it’s suitable for the stage and type of investments your fund owns. Most fund managers review and update their fund valuation policies on an annual basis. Does yours need updating now?

Further Reading

That’s all for today folks! Thanks for your support and spreading the word!

Share this on Twitter or LinkedIn to help grow “the crew!”