- TheFundCFO Newsletter

- Posts

- #96 The Case for 30+ Co.'s Per VC Fund

#96 The Case for 30+ Co.'s Per VC Fund

Hi Everyone! 👋 Welcome to the new members of @TheFundCFO crew! We recently launched a paid tier and released our VC Fund Playbook + Models @ Streamlined.Fund! Re-linking some top 2023 posts: #67 Top VC CFO Posts & References & #65: WTF is Going On in VC (+ New Fund Model Data).

Every Tuesday/Thursday, we bring you actionable tools, real-world experiences, and insider insights for #VC CFOs/Finance Pros and fund managers, #LP investors, and industry enthusiasts/people who want to learn :). As a reminder:

Tuesday: insights + interviews. Free for everybody.

Thursday: deeper dives on VC GPs, CFO/COO strategy, more insights from LPs/GPs, and our take on what it all means (from 15+ yrs. of experience). Exclusive to Paid subscribers (most of whom expense these insights).

“The distance between your dreams and reality is called action.” -Unknown

The Case for 30+ Co.'s Per VC Fund

Portfolio construction is a hot topic for VC funds and LP investors. Before investing, almost every LP will ask a VC: what is your portfolio construction strategy? There’s a lot of data, conventional wisdom, and strong thoughts on this. Some say concentrate. Others say diversify. What’s the right approach for the average VC fund? We’ve written about this more here:

Where do we stand today? We’ve talked to a lot of VCs. Even though a lot of VCs talk about the benefits of concentration, if you look deeper, almost all of them are getting >30 investments in a fund. They may say something like “we’re concentrated - our top 10 positions make up >50% of our fund.”

While that may be true, most VCs we talk to are still likely to have made a number of smaller bets to get to >30 companies. These VCs often build their ownership/ concentration in high-conviction companies over time, via additional primary and secondary investments.

Every VC has a slightly different approach and they ultimately choose what they feel is best. Let’s bring in some experience and data-driven insights to share some more light on this topic!

Portfolio Construction Insights from Data-Driven Investors

Moonfire VC: How to Design the Optimal Portfolio (2023) - 25-30 per fund

Moonfire, a London-based VC, released their portfolio simulator this year. They ran nearly a trillion portfolio simulations to determine the optimal portfolio construction for a VC fund. Here's what they found: “Determining the optimal size and strategy of an early-stage VC portfolio is an art, with as many answers as there are firms.”

“That said, there are two main camps: 1) a small, concentrated portfolio, betting on the best companies you can find, or 2) as large a portfolio as possible, acting like a sort of index of the market. And there are plenty of successful examples from both ends of the spectrum.”

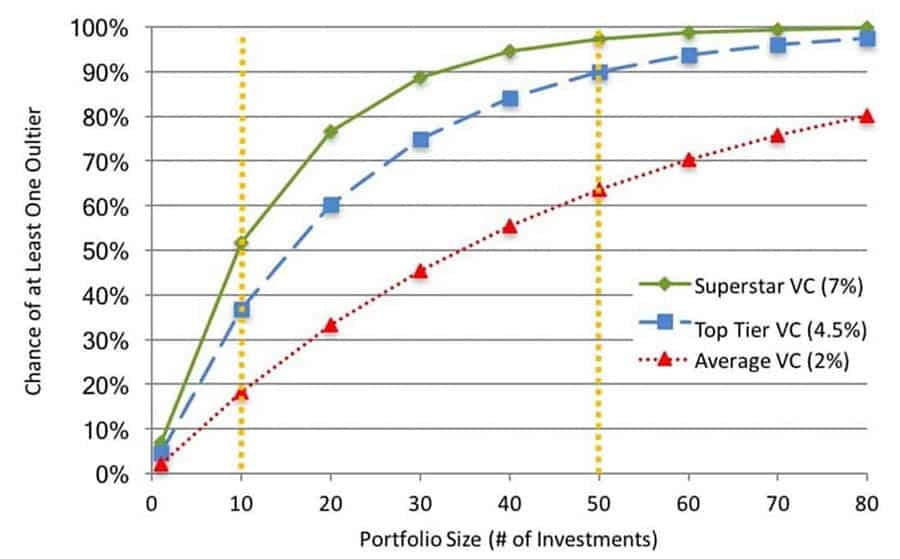

“At Ulu, we have chosen 50 as our minimum portfolio size. We believe our capabilities are comparable to the top-tier VCs, giving us a 90 percent chance of having an outlier in our fund.

Successful VCs need at least one outlier to have a well performing fund. The y-axis measures the chances of investing in at least one outlier as a function of the size of the portfolio (the y-axis) and the chance of an outlier with each investment for 3 different types of VCs (the colored lines).

Fred Wilson (USV): Our Model (2017) - 20-25 investments per fund

Here are some highlights from Fred Wilson at USV in 2017. I wonder how this has changed (I suspect the number has increased)?“We make between twenty and twenty five investments per fund and we expect, hope, and work hard to make sure that two or three of those investments turn into high impact companies that can each return the fund.”

💸 Summit Peak has backed 11 early stage fund managers with 592 underlying companies…

🥇 The Top 5 companies (0.8%) represent 50% of the fair market value!

🏆 The Top 25 companies (4%) represent 77% of the fair market value!

📊 The numbers show a real example of the “Power Law” in action & demonstrate how pronounced it is in venture capital.

💡 What does this mean for investors?

💼 It suggests diversification is VERY important in *early* stage venture.

🔮You need shots on goal to capture the companies of consequence - no one has a crystal ball.

📈 It “sounds” better to specialize & have a concentrated strategy...but the data says otherwise.——🌟 AngelList & CB Insights have shown (analyzing 3000+ companies) that on average 1-2% of seed stage startups achieve unicorn ($1bn+) status.

That’s all for today folks! Thanks for your support and spreading the word! Share this on Twitter or LinkedIn to help grow “the crew!”